Finance Minister Professor Mthuli Ncube proclaimed that prices in Zimbabwe would start falling next month, July. This was said in a prerecorded statement presented to the Board of Governors of the African Development Bank who we’re meeting in Malabo Equatorial Guinea.

The statement made the usual reference to the transitional stabilization Programme, budget surplus, fiscal consolidation and liberalization of the exchange rate. However, there was no detail as to what indicators suggested that prices would at any point decline. The Herald reported the story with the headline Prices to decline next month, though what the minister in fact said was that the positive results the government has been recording would start to have an effect on prices in the 3rd quarter of the year.

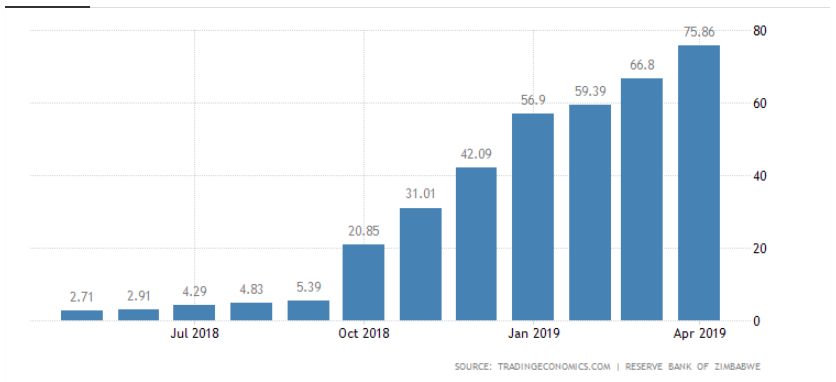

The reality on the ground may disagree with Ncube’s assessment. The April inflation figure came in at post dollarisation high of 75.86%. We are due to receive the inflation data for May and Trading Economics analysts are expecting it to come in at 90%. The analysts’ position shows a trend quite to the contrary of Ncube’s statement.

Zimbabwe Year-on-Year inflation

The finance minister has spoken about this before on many occasions with varying detail. Most notably he has proclaimed before that the rate of inflation will slow in October of 2019. This is really just mathematical interpretation as prices first jumped in October 2018 but with current inflation trend, it may prove to be an insignificant slowing. Perhaps more attention needs to be paid to the ground than to the policies they are churning out.

The current conditions are dire for many in Zimbabwe as those goods which are available continue to increase prices rapidly. Those where prices have not changed have major availability challenges. The nation is currently grappling with electricity supply challenges that have lead to rolling power outages that can go as long at 18 hours. The shortages of both diesel and liquid petroleum gas make for a more complicated situation as the two reliable alternative energy sources.

The RTGS dollar has proven to be a very poor store of value and while President Emmerson Mnangagwa has lauded it as the strongest currency in Southern Africa, a quick look will show that in its 4 months of existence the currency has lost 72% of its perceived value at a time when the South African Rand and Botswana Pula have lost 6.9% and 2.1% respectively.

All this while there is talk of introducing another new currency yet again.