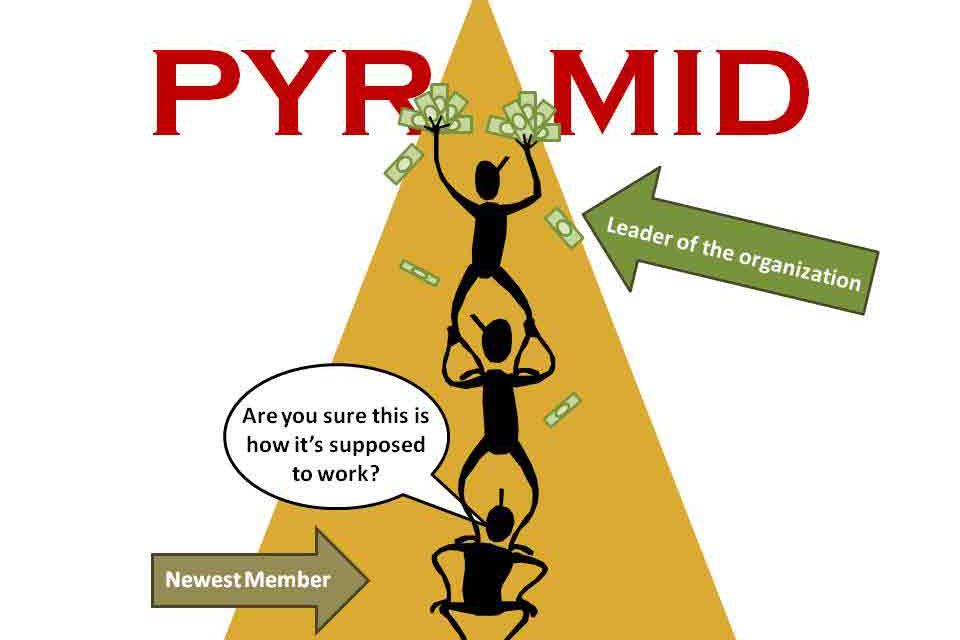

Did you know that a pyramid scheme is classified as an actual type of business model rather than a scam or fraud? This is because it is literally impossible for a pyramid scheme to defraud you—once you are part of one of these it is far more likely that you will be the one deceiving people (either intentionally or not). If you have ever lost money to what you think is a pyramid scheme, it was probably a Ponzi scheme instead. This distinction is often overlooked but pyramid and Ponzi schemes are two different things with the latter being the one involving fraud.

Dishonesty is for Ponzi schemes

At its most basic, a pyramid scheme is a business model that pays current members for recruiting new ones. The money for paying the recruiters comes from the fees paid by the newer members upon their joining and consequently becoming recruiters themselves. These “joining” fees are the only money that these operations generate, hence in order to continue functioning they always need new members. Most Ponzi schemes, on the other hand, work hard to pass themselves off as genuine investment opportunities. In order to lure people in, the promised percentage returns on “investments” are often outlandish. Unlike their pyramid counterparts, Ponzi schemes do not pay you for recruiting members—instead, they repay earlier contributors (plus the promised interest) using money from the latest contributors.

As you can see, someone running a Ponzi scheme has to make fraudulent claims and can easily abscond with the contributions even before the scheme naturally collapses. On the other hand, earning (and recovering) your money from a pyramid scheme solely depends on your ability to convince others to join. However, for all involved, both of these are unsustainable money-making schemes which ultimately have to submit to the laws of mathematics and collapse.

Their popularity among the educated

Someone once said that lotteries are a tax for people who are bad at math. Something similar can be said about pyramid schemes since a joining participant never has any real idea how far down the pyramid he/she is. This information is important because it not only determines how much if any, money they can make from the scheme but also how far away it is from collapse. The further you are down the structure, the less likely it is for you to make any money sometimes this means losing more money to the scheme than that which you can gain. Much like the optimistic lottery player who fails to appreciate the unlikelihood of their winning, the majority of pyramid scheme participants do not understand how unsustainable these schemes are or how uncertain their chances of making any money are.

However, the argument that the allure of pyramid schemes, similar to that of lotteries, may be caused by ignorance falls flat when you consider the fact that most of these schemes are popular even among the more educated. As parts of efforts to make ends meet, varsity students are some of the most active evangelists and participants of these schemes. Indeed more and more promotional messages for these schemes are evidently directed at unemployed, underemployed and otherwise dissatisfied graduates.

How they are sold to people

Joining pyramid schemes (and paying for the privilege) is often sold as an investment and the participants are not shy to refer to themselves as entrepreneurs. They often share quotes from successful people such as Steve Jobs, Bill Gates and Richard Branson. Most of the invitations to join these schemes often taunt their targets’ low incomes, lack of ambition and unwillingness to take risks.

The internet has allowed groups and individuals to create and operate international pyramid schemes with impunity. These do not have to hide their true nature; instead, they sell themselves as alternatives to the traditional financial institutions which “exploit” people. They usually go out of their way to assure current and future members that their schemes are just communities of people helping and protecting each other from the tyranny of financial institutions.

Schemes masquerading as multi-level marketers

In order to avoid the attention of authorities, a lot of pyramid schemes attempt to hide their true nature by pretending to be legitimate businesses. They often do this by adopting business models that on the surface look like multi-level marketing. This is an obvious choice on the part of the creators of these schemes as even the most reputable MLM companies constantly get compared to and accused of being pyramid schemes. Some famous companies also combine elements of both multi-level marketing and pyramid schemes. People can then participate in these genuinely believing that they are actually selling products before they discover on their own that recruiting others is far more profitable.

The enthusiastic participants

An increasing number of people nowadays fully understand how pyramid schemes work and all the risks that are involved; however these people are still very enthusiastic about participating, with some participating in several such schemes at the same time. For these people, the risk involved is acceptable in the same way that a gambler (or even a business person) may be aware of and acknowledge risk but still find it worth it.

In conclusion

As can be seen here, for most pyramid schemes, lying to people rarely offers any significant benefits. This means that most of them are fairly upfront about what they are with the exception of those that draw unsuspecting people in under the guise of employment or multi-level marketing. However, make no mistake, most of these schemes are either illegal or frowned upon in most parts of the world.