I wouldn’t call myself a computer genius by any measure but I can do some things with computers. Amongst the things I can do one of the most important to my journey in employment, business, personal finance and investing is the ability to work with spreadsheets. Spreadsheets are the tool for tracking, managing, measuring, processing and presenting data. I see a lot of people who suffer in some of these pursuits because of their lack of spreadsheet skills. I could go on and on about how wonderful spreadsheets are but I always it is better to show than tell. I’m passionate about encouraging people to master spreadsheets because I have very little formal training on how to use them. I am largely self-taught out of interest. Here are some applications for spreadsheets.

Business administration

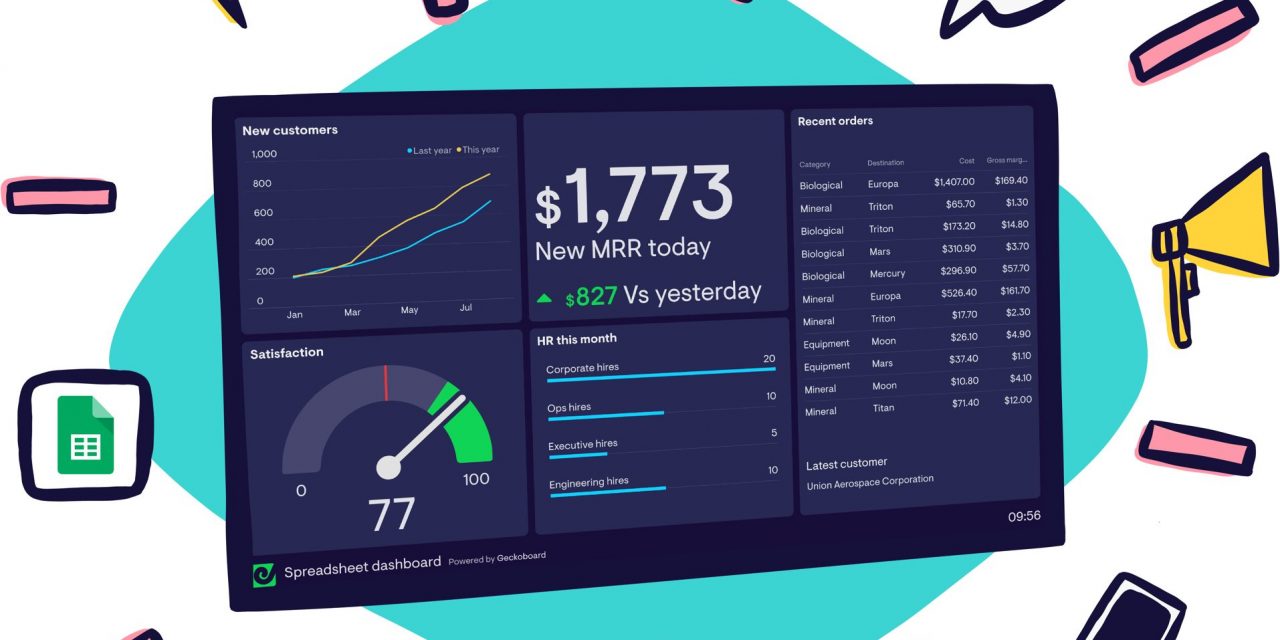

Administration tasks are not anywhere near being the attractive part of running a business. Be that as it may, administration tasks are a critical part of running a business. You can run the greatest business but if you can’t keep records of it you really won’t have the greatest business for long or you will stunt your growth. With a good enough understanding of spreadsheets, you can easily run your entire bookkeeping function through them. Invoicing, accounts receivable, profit and loss accounts and even performance dashboards are all possible. Data analytics functions are also embedded into most spreadsheet programs and applications.

Personal finance

I’m a fan of personal finance applications which cater to specific circumstances we experience in our personal finance journeys. That said there is absolutely no need to tie yourself to a personal finance app, it’s a need for data and cloud storage if you have decent spreadsheet skills. You can easily track all your income and expenditure via a spreadsheet then take a step further to analyse and manipulate the data. Other critical personal finance tasks such as budgeting (both planning and reviewing) can be easily executed with a spreadsheet. They are also great for modelling and tracking your journey.

Investment tracking

Investing is a highly encouraged activity if and when you are ready to start investing. That is ready both mentally and emotionally. A very important p[art of the game of investing is of course tracking your investments or as I prefer to call it, counting your money. If you are investing through an asset manager and if your entire portfolio is with them then this work is mostly done for you. However, if you are not going through an intermediary or simply want to track your investments over a different horizon than what is offered spreadsheets hold the answer for you.

Reporting

No matter what you do for a living you report to someone. Sometimes that someone is yourself. You might let yourself off but those who have to report to bosses, investors, customers and other stakeholders, you would do ourselves a favour if we were good at it. Those who are fortunate will gain reporting via spreadsheet skills in the course of studying or employment. Spreadsheets give you so many tools that can make you a reporting wizard. Dynamic charts, dashboards, modelling and basic charts are all a part of the package. Perhaps your pitch to investors isn’t working because you’re not communicating the story that the data should be communicating

Knowing what you know now, why haven’t you hopped on the spreadsheet bandwagon? If you have, why aren’t you a master yet? You can enrol in taught classes if that’s your thing. If you prefer to self teach there are many books out there supported by video content to help you to become a master of the spreadsheet arts. It really doesn’t matter how you do it, learning to work with spreadsheets will boost your abilities in so many functions that are important to your development in employment, business and personal finance.