The Zimbabwean economy has certainly been through some things. There’s no better way to put it. Through hyperinflation, dollarisation, the return of the Zimbabwean dollar through the bond note before taking its full form and the current state we have seen many things. 2022 presents a new year and perhaps a new hope but certainly new challenges. As we look forward to the year let us take in the current state of the economy.

Gross Domestic Product

The Gross Domestic is a measure of economic activity in the country. We can simply take it as a measure of the money made domestically by Zimbabweans. The size of Zimbabwe’s informal economy plays a huge part in this being difficult to measure and therefore forecast. As the graph below depicts the dollarisation years brought a lot of GDP growth for the nation. The return of the Zimbabwean dollar in full in 2019 was met with a decline in GDP. Current estimates suggest that 2021 GDP will return to pre-Zimbabwean dollar levels (7.8% growth) with a growth of 5.5% projected for 2022.

The 2022 budget was drafted in line with the National Development Strategy 1 document and this consistency is welcome. Zimbabwe has long suffered from inconsistent policy direction. However, this doesn’t guarantee success as there are other issues-particularly in money supply and inflation which will have a say. We will look at those as well.

Inflation

Inflation has been the bane of Zimbabwean citizens’ existence. We will reiterate that things are much better than they were a year ago but inflation is still very much in the troubling territory. Slashing annual inflation from 840% to 50.24% in one year is nothing to sneeze at. Fiscal discipline contributed heavily to this. Since reaching that low in August 2021 inflation has started on the uptrend again. Closing the year at 60.74%. Trends suggest that there is no reason to expect the inflation picture to improve. There is of course the caveat of the behaviour of authorities that can swing this.

Money supply growth played a large part in the inflation rate with marked increments towards the end of the year in the broad money supply. The Reserve Bank has committed to limiting money supply growth but the results have varied. The tail end of 2020 saw a great period of fiscal management. The tail end of 2021 not so much. The pressure was also experienced on the foreign exchange market.

Trade Balance

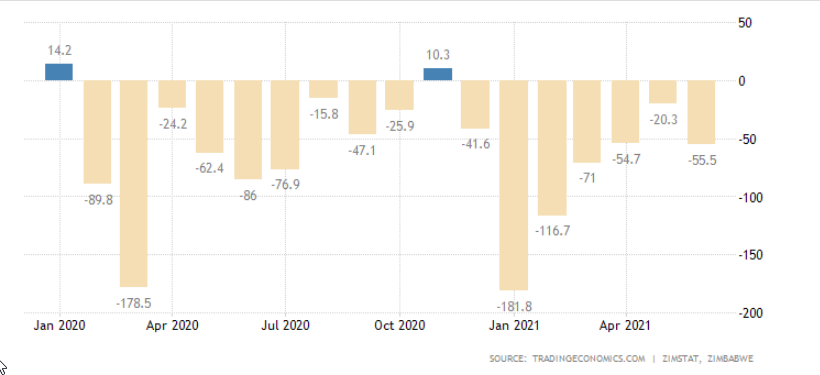

Zimbabwe remains a net importer and this coupled with the foreign currency shortages will plague the economy in the foreseeable future. This will continue to put pressure on the little foreign currency that is available in the nation. Efforts at import substitution have been at the very least been talked about. There have been a few victories but the nation remains dependent on imports.

Exchange rate

Zimbabwe’s official auction system managed to bring some relative stability to the price of foreign exchange in 2021. However, the auction system still excludes the country’s huge informal sector and this dilutes its effectiveness of it. The parallel market for foreign currency has a much more pessimistic view of the Zimbabwean dollar’s value against the US dollar offering a premium of 100% compared to the auction market to sellers of US dollars. A premium that historically hung around 30 to 40%. According to some corners, the closure of the foreign currency auction market over Christmas sent businesses to the parallel market and caused a huge spike in the depreciation of the Zimbabwean dollar, which has not abated despite the resumption of the auction.

The COVID-19 factor

Zimbabwe went on a large vaccination drive with the target of achieving herd immunity by vaccinating the majority of the population. According to our world in Data, Zimbabwe has administered 49.78 does per 100 people. This is doses so we can roughly (assuming 2 doses per person) say just under a quarter of the population at best has been vaccinated. Though we must be careful with this as some have received third doses (booster shots). This places Zimbabwe 12th in Africa and very far down in world rankings. More importantly, it falls below the target Zimbabwe set for itself. This is very important for the economic outlook as the coronavirus has shown new variants and there is talk about it becoming an endemic disease.

The Zimbabwean economy presents many questions that while answers have been provided with the answers do not seem quite adequate. The twin issues of inflation and exchange rate will likely prove to be very difficult challenges for the nation to deal with as it has been in recent years. A bumper agricultural harvest in 2021 seems like it will not be followed by the same in 2022. The ability of the government to act on issues that affect the growth of the economy require financial muscle which just isn’t present. The economy is in a better place than it was 12 months ago but that may not remain the case.