Growealth continues on its quest to inform the public about Unit Trusts and their performance so far in the year. We really appreciate this as it gives us a chance to look at one of the few short term investment alternatives accessible to Zimbabweans. It’s also useful to compare the Unit trusts to other short term investment alternatives. This time around we will include money market and interest-bearing unit trusts, though in a separate analysis from equity-based unit trusts.

Equity and Property-based unit trusts

We will group these for no other reason than the way the returns are measured and presented in the Growealth report. We have a discernable year to date (YTD) performance given as a percentage. Have a brief look at the chart below which shows the YTD performance of the 22 (up from 21 the last time we checked) unit trust funds in the Growealth report.

As you can see the best performing Unit Trust Fund was the Platinum Child care Fund bringing 197% return in the first 6 months of 2021. That’s just about 3 times your money which makes it a very good rate of return by any measure. Comparing the unit trusts to inflation (black bar) you can see that all but 2 of the funds beat inflation (20.69%) in the period. This is commendable especially considering the lowest performer amongst those that beat inflation (Atria Balanced Fund 59%) came in at almost 3 times higher. The two that failed to beat inflation are the Old Mutual Property Fund (8%) and the Zimnat Property Fund (14%). This is not unexpected as property, particularly commercial property has seen the worst of the Covid-19 pandemic. The best manager based on YTD returns goes once again to Platinum who occupy four of the top 10 positions. Smartvest and Datvest look pretty good too as does ABC with its stable equity fund.

We also have the ZSE All-share index, Top 10 index and Small Cap index (all blue bars) to compare to. 7 of the 22 unit trusts outperformed the ZSE All Share Index (135.60%). The comparison is academic as we do not have a way to buy the ZSE ASI yet. Compared to the top 10 index all but 4 funds have beaten the index’s performance year to date (90.66%). The top 10 index which can be bought through Old Mutual ZSE Top 10 Exchanged traded fund (ETF) is a reasonable comparison. The ETF underperformed its benchmark bringing investors back 79% year to date, therefore, being beaten by all but 3 funds. The darling index of the ZSE the small-cap index at 1500% is untouchable by any unit trust fund. If we compare the best unit trust fund (Platinum child care fund) to individual ZSE counters it would place 26th on the list. That said there are no negative performers amongst the unit trust funds.

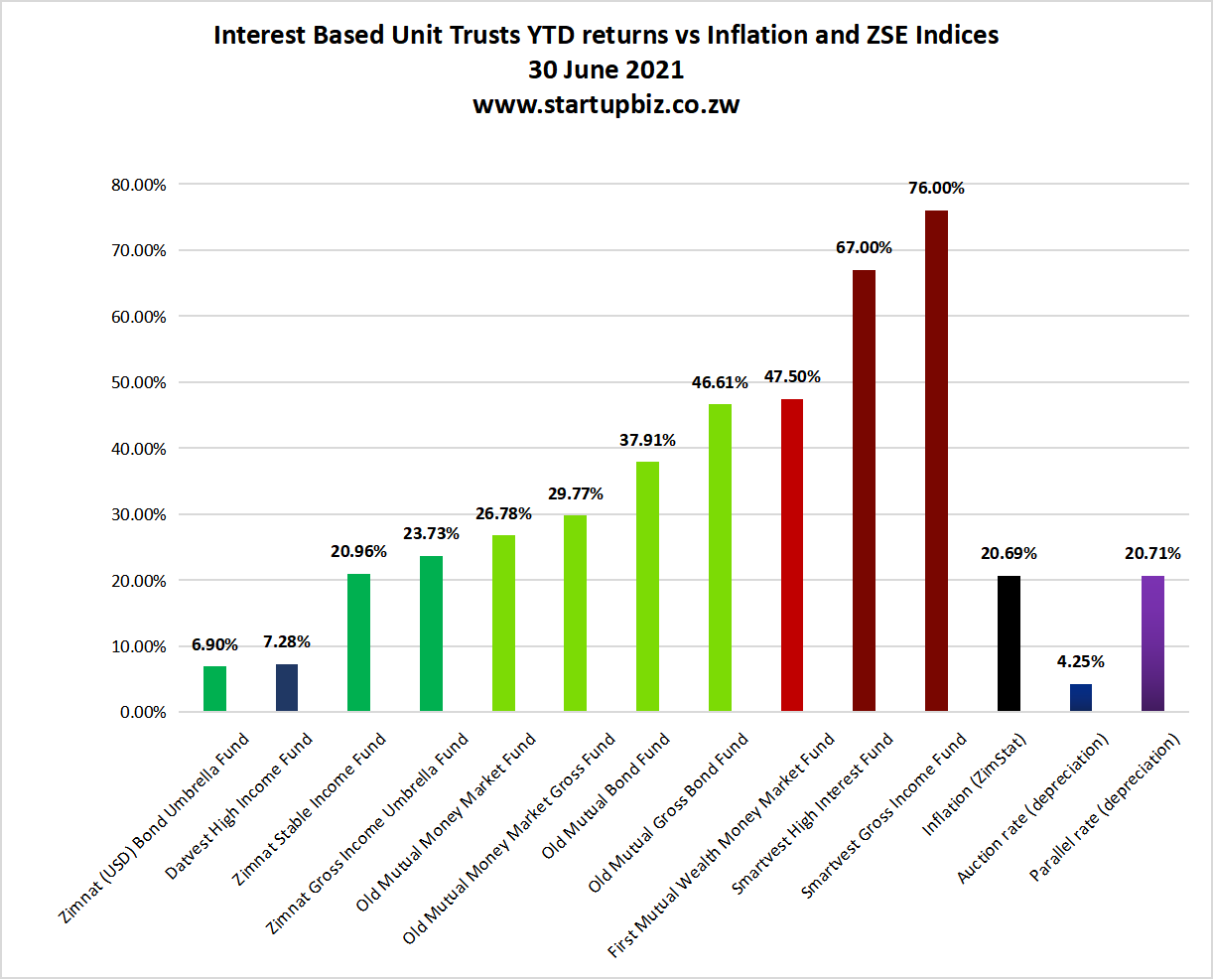

Interest-based funds

We had to look at the interest-based funds separately because the performance cannot be assessed in the same way. The Zimbabwean economy has not been very kind to interest-based products thanks to high inflation. The tune has of course changed as the central bank has reigned in money supply growth leading to a slowing in inflation and exchange rate depreciation (purchasing power parity). The chart below shows the 11 interest-based funds presented in the Growealth report compared to inflation and exchange rate depreciation.

9 of the 11 funds outperformed year to date inflation according to ZimStat’s CPI measure. The Zimnat Bond Umbrella Fund is UD dollar-denominated so this can be expected. The best performing fund is Smartvest’s Gross Income Fund (76%). The fund actually outperformed the exchange rate depreciation on both official (4.25%) and parallel (20.71%)markets. The funds have performed very healthily in 2021 though they clearly lag the equity and property-based funds. Just a note these are annualised yields so this is the return expected in a year.

All things considered, the unit trust funds are regaining their lustre. Please remember the comparison’s here are academic. Not all funds are created equal and there are matters to consider outside the rate of return such as ease of entry and exit and time to maturity. If you’re interested you will need to contact the individual providers who you can find in this article on investment companies in Zimbabwe. Old Mutual Unit Trust Funds are also Available on Ctrade.