The world over a lot of noise is made about stock market indices. The Zimbabwe Stock Exchange last year announced plans to or organise ZSE counters into indices. So what was all the fuss about? What use are indices to the average investor? What use are indices to the average investor in Zimbabwe?

What is an index?

Indices in simple terms are the average of a group of shares with some binding characteristic though not always. When you watch the markets and hear quotes for things like the S&P 500, the Dow Jones, France’s CAC 40, Japan’s Nikkei 225 and Londons FTSE 100 these are all indices of some sort. The ones with numbers indicate the number of counters included and are usually a top selection from the entire exchange. In Zimbabwe, the ZSE introduced indices based on industry classification and size of capitalisation of counters. So we have the ZSE All share, Industrial Index, Small Caps index. The indices we have to use a similar characteristic concept based business tenets or size of the capitalisation (how big the total value of the company is).

The index is an average of all the shares that count towards that index. This average is normally stated in points rather than a monetary value. By averaging together the price movements if a group of counters with similar characteristics you get a picture of how they are performing together.

Why does it matter?

Indices can be very useful to investors. Stock market investing is nothing short of complex and a lot depends on the system you are in. Let’s say you have your eye on an industrial company listed on the ZSE. Given Zimbabwe’s monetary complexities from the past, you really don’t have a measure of how well the share price is doing compared to say a year ago. A look at the industrial index of the ZSE will give you the average price performance of all industrial shares in Zimbabwe. You can compare this to your desired company and see if the price-performance is above average or below average. This will help you get an idea of how well it is doing compared to peers. It is easy to compare to the whole exchange and while this too is an index and therefore worth checking, many companies may not be facing similar conditions birth good and bad because of the industry they operate in.

Another great use of indices has been the emergence of the index fund. An index fund is a fund managed by experts which mirrors a particular index. It pools funds from investors and then invests these funds in similar proportions and weights to the shares on the index. The index fund was popularised because of the long researched and recognised reality that in the long term exchanges and indices go up and it was much wiser for the average investor who had a long term view to stop wasting time, money and effort on trying to pick the best stocks and rather just mirror the index. Index funds are favoured because the job of the fund manager is to update the shareholding weights rather than make calculations on which is the best to pick, the index does that for you.

ZSE indices

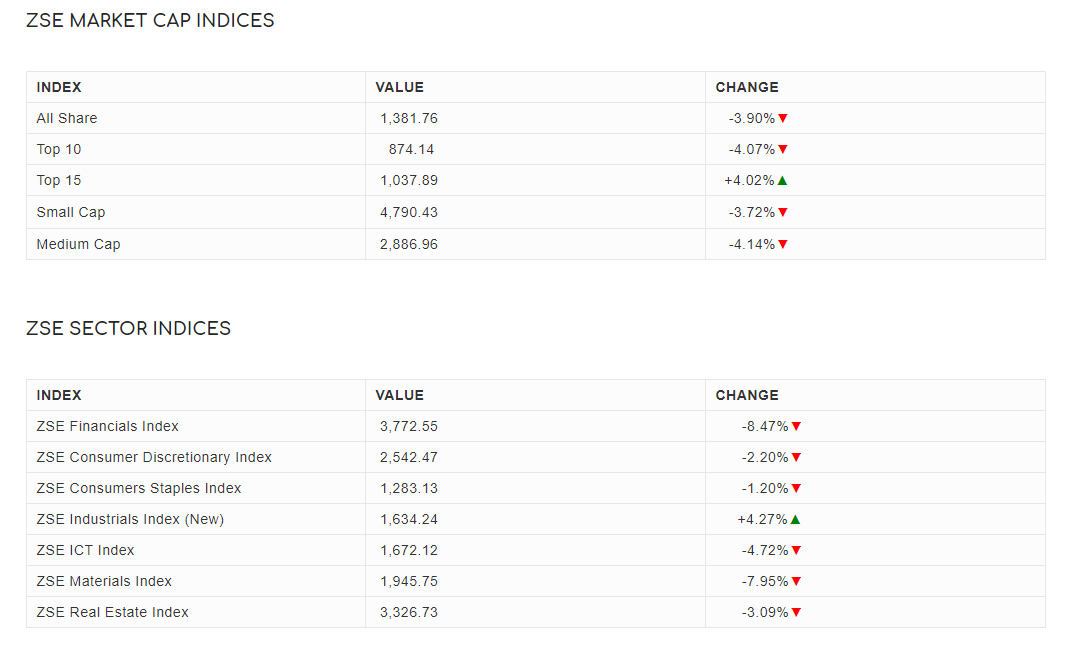

All in all the ZSE publishes 12 indices (including the all-share index). Of the remaining 11, 4 are market capitalisation (size) based while the other 7 are sector or industry-based. The market-based ones are the Top 10, Top 15, Medium Cap and Small Cap indices. The sector based indices include Financials, Consumer Staples, Consumer Discretionary, Industrials, ICT, Materials and Real Estate. These are published and updated daily.

How to use them

As I’ve already indicated you can use the indices in many ways. They provide great comparative data on the movement of your favourite companies compared to the index and see how well they are performing. Perhaps their performance is down to individual brilliance or a general industry high. You can also design your own index fund. It sounds complicated but the relatively small size of the ZSE with 50 odd counters is nothing compared to the S&P 500’s 500 and the NASDAQ’s 3300 companies. As an example, the all share index in Zimbabwe has outpaced inflation so far this year and brought back very good returns if you could invest in it as a whole.

In conclusion, I always try to explain to people that what matters with stock market investing is not the movement of a stock up or down but knowing the why behind the movement. Stocks will go up and down but if you possess the knowledge as to why they are going up or down you will also know when the trend reverses or at least have a good sign in time. These published indices help investors in part to understand that why.