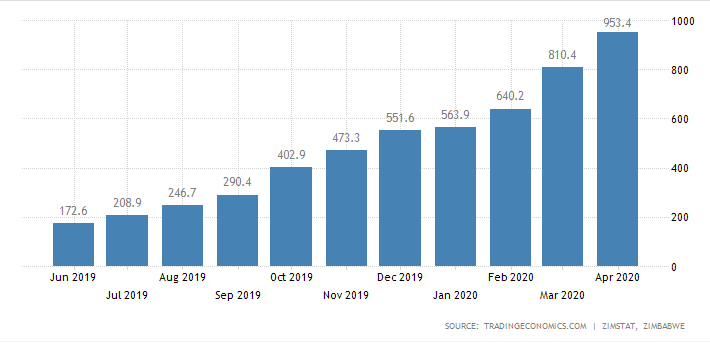

Zimbabwe’s inflation rate has been on a rampage for the last two years. The latest report from Zimstat placed year on year inflation at 767%. As a result of this, the information contained in company financial statements becomes meaningless on a historical basis. Last year the Public Accountants and Auditors Board informed all members that they may use International Financial Reporting Standard IAS 29: Reporting in Hyperinflationary Economies which gives guidance to preparers of accounts in hyperinflationary economies. Results that have been reported by Zimbabwean companies this year (for 2019) use the accounting standard but how does it work?

IAS 29

The objective of IAS 29 is to establish specific standards for entities reporting in the currency of a hyperinflationary economy so that the financial information provided is meaningful. There are a multiplicity of users who rely on financial statements for different reasons. Anyone from shareholders, lenders, creditors, prospective investors, institutional investors and the government. As such presenting transaction data alone is not enough, the data and information derived from it may need further treatment to be useful. For the benefit of those not familiar with hyperinflation historical cost does not give a true representation of transaction value. Time value of money is a concept that is usually measured in years but in a hyperinflationary environment, it can be measured in days. Assets, revenues, liabilities and shareholders equity are all affected by this just as income and expenditure are. IAS29 provides two methods for accounting in hyperinflationary economies.

Current Purchasing Power (CPP)

The first methods uses the Consumer Price Index (CPI), which inflation statistics are based on to calculate a current value for transactions or items in the accounts. Under this method, monetary items and non-monetary items are separated. Monetary items are items such as cash, debtors, liabilities which have a value expressed in dollars and this does not change. If I deposit ZWL$100 into the bank it remains a ZWL$100 deposit. These items do not change in the accounts.

Let’s use a simple example to illustrate how this works.

If you bought an asset for ZWL$10 000 in June 2019 to find its value today you would divide by CPI on the purchase date and multiply by CPI today (April 2020 is the most recent we have so we use that);

10000/172.6=57.9374

57.9374*953.4=55,237.5172

Your asset value would be recorded as ZWL$55237.52

Current Cost Accounting (CCA)

The Current Cost accounting approach values assets at their fair value in the market rather than the price incurred during the purchase of the fixed asset. Under this method, both monetary and non-monetary items are restated to current values. This involves keeping track of the fair market value of assets. This is not always practical especially in a hyperinflationary environment where prices can move daily or hourly. Using a similar method to CPP of applying a conversion factor based on the index is more appropriate though it may not always be accurate.

Practical Application

Both methods are acceptable under IAS29. The few inflation-adjusted financial statements I have had the opportunity to peruse use the Current Cost Accounting method. As stated earlier this paints a picture that is easy to understand as everything is stated in today’s money terms. This gives a better picture of performance and is particularly useful if the company in question has been keeping balances of monetary items low. Many have learned this lesson from 2008 and have done so accordingly.

Problems

There are problems with these approaches that are specific to the Zimbabwean situation. In the asset example, I used Zimstat reported CPI figures but we are well aware that there are other measures which are discordant with Zimstat figures and the Zimstat figures rarely reflect the situation obtaining on the ground. A reliable measure or index is important to keep the information useful.

What It Means

The financial statements we have been presented with use International Accounting Standard (IAS) 29 rules for dealing with reporting in a hyperinflationary economy or currency. This means to some degree the information better reflects the real meaning of information that has been recorded at previous prices. Across the board, auditors who are responsible for making sure information contained in financial statements are accurate and reliable have expressed negative opinions or not expressed opinions at all. This simply means they cannot stand behind the financial statements due to measurement issues and we should not wholly rely on them. While inflation accounting has been applied, the information is not quite reliable.