After the budget came to the monetary policy statement, Reserve bank Governor Dr John Mangudya delivered the 2023 Monetary Policy Statement on the 2nd of February. There are always highlights in the monetary policy statement. The statement looked at the past 12 months and how interventions have performed. More important than knowing the highlights is understanding what they mean. Let’s pour through the highlights and divine their meaning of them.

Bank policy rate down from 200% to 150%

Broad money supply has plagued the economy, as evidenced by both inflation and the exchange rate. The RBZ hiked lending rates to 200% to curb money supply growth. After numerous interventions, we are in a better position, and the RBZ saw fit to reduce rates to 150%. This will make it easier for businesses to borrow and increase the flow of money in the economy.

Medium-term bank accommodation down from 100% to 75%

The medium-term bank accommodation facility for productive sectors was also reduced by a quarter from 100% per annum to 75% per annum. As the lengthy name suggests, the facility is for lending to productive sectors of the economy and will provide cheaper finance to those sectors. The ultimate goal here is an expansion of the productive sectors.

Minimum deposit interest rate 30% for call accounts and 50% for time deposits

Deposit interest rates on Zimbabwean dollar call accounts were increased from 7.5% to 30% per annum. Given the Zimbabwean dollar has a high velocity (people move it on very quickly), encouraging savings is paramount. While the interest rate is much lower than the current inflation rate, one should note that it is the upper target for year-on-year inflation, which we will look at later. Time (fixed) deposit interest rates were set at a minimum of 50% per annum, up from 20%. For foreign currency accounts, the interest rates are 1% per annum and 2.5% per annum for call and time deposits, respectively.

Statutory reserve requirements

Statutory reserves, the percentage of money banks are required to keep on hand, were standardised. They must maintain 10% of demand and call accounts on hand. For time deposits, they will be required to keep 5% on hand. This applies to both Zimbabwean dollars and foreign currencies. Statutory reserves maintain short-term bank liquidity (the ability to avail depositors’ money). This is about maintaining trust in the banking system.

Gold coins to stay

One of the big topics of the last year was the Mosi Oa Tunya gold coins. Despite criticism from many corners, the Reserve Bank of Zimbabwe has doubled down on the Open Market Operation, stating that it will maintain its existence and provide more upon demand. The operation has been critical in slowing down the velocity of the Zimbabwean dollar thanks to the lock-in period.

WBWS given more strength

The willing buyer, willing seller (WBWS) or Interbank system was given more strength. We do lament the tongue twister of a name the system has, and perhaps the governor and team could world on simplifying the names of some of these systems. Surrender receipts will be sold wholesale to the banks, presumably for on-selling to the public at the interbank rate. If you think this idea sounds familiar, this is how an open foreign currency system works. So is the RBZ preparing the interbank system for the future? Their statement also maintains that the auction system is essential to the economy, not just yet.

75% export forex retention, even for VFEX-listed companies

Export foreign currency retention is always a big talking point in Monetary Policy. The export foreign currency retention rate has been standardised across the board to 75%. This means companies that export will be required to exchange 25% of their foreign currency receipts immediately for Zimbabwean dollars and retain 75% as foreign currency. The 100% retention on incremental exports will be suspended. The statement doesn’t amend any other rules, so it looks like all other rules remain the same. This isn’t great timing by the RBZ as several companies have committed to the move from ZSE to the VFEX, presumably chasing the benefits, which included improved export proceeds retention.

85% forex surrender on domestic transactions

Domestic foreign currency retention has been set at 85%, up from 80%. With recent news from ZimStat that over 70% of transactions in Zimbabwe are happening in foreign currency, the RBZ has likely received increased foreign currency inflows from domestic transactions. While one would think this would please the RBZ, exchange rate management is about balance, not greed. It is also in the bank’s best interests for businesses to be happier dealing in foreign currency.

Export of currency or Gold Coins up from US$5K to US$10K

Zimbabweans can export foreign currency up to US$10 000 or equivalent in other currencies. The same applies to Gold Coins, which can also be exported. The US$10 000 limit applies to Gold coins and foreign currency, so the two will be aggregated.

Export of bond notes limited to 10K USD equivalent

There’s always something that inspires a chuckle in the monetary policy statement, and the export limit for bond notes being set at the equivalent of US$10 000 certainly did. Many asked where anyone would be going with bond notes. We will defer to the RBZ team’s wisdom on this one.

Export of “Trillions” limited to 100 pieces

The old demonetised Zimbabwean dollar notes from the “2008” era, known as “Trillions” also received an export limit of 100 pieces.

50% surrender on overdue export proceeds

With somewhat confusing wording, the RBZ offered what seems to be a 50% “discount” on overdue export receipts.

exporters with overdue export receipts to repatriate the export proceeds, exporters in this category shall, with immediate effect, be entitled to retain 50% of their export receipts and liquidate the balance into local currency at the prevailing WBWS exchange rate

If we have understood the wording correctly, they will only have to surrender 50% of what is overdue at the prevailing WBWS rate. An olive branch from the RBZ is always a welcome development.

Capital adequacy extension

Bank Capital adequacy is the amount of capital bank owners must put in to maintain their bank license. Banks had been given until the end of 2022 to be compliant. Now the deadline has been extended to the end of 2023, but those banks that have not yet met adequacy requirements will need approval from the RBZ to pay dividends to shareholders.

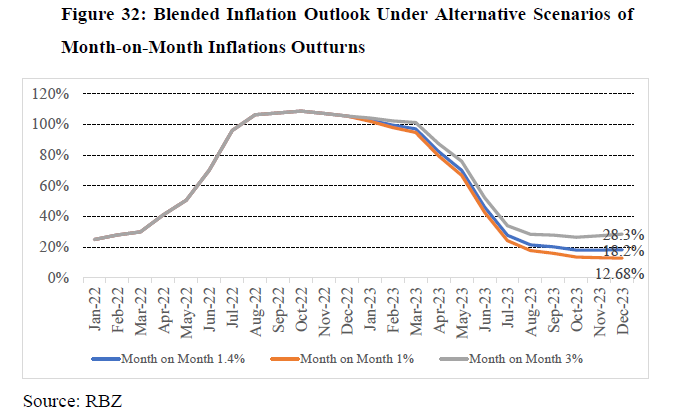

Inflation outlook

The RBZ has set inflation targets of less than 1.5% month-on-month and between 10 to 30% year-on-year. We last saw year-on-year inflation figures that low in November 2018, the month after the fateful separation of Bond notes and US dollars. That was nearly five years ago. The same has to be said for month-on-month inflation. However, the RBZ insists that ZimStat should use blended CPI as the primary reference rate and these figures are achievable in blended CPI.

Small victories in foreign currency retention and interest rate reduction for businesses in Zimbabwe. For all its shortcomings, the auction system will stay while Gold Coins will continue. The ambitious inflation targets remind me of similar targets in previous years, which went missed in their respective years.