It may seem like all is normal but the Reserve Bank of Zimbabwe is sweating bullets over the push by the parallel market exchange for the symbolic 200 mark. In a statement circulated late yesterday, the bank announced some measures that came from a meeting with unnamed business leaders. The statement however left us with more questions than answers as the measures announced ranged from ineffectual to comical.

Press-Statement—Meeting-Between-RBZ-and-Captains-of-Industry—-11-10-2021

The statement starts by mentioning that parties unanimously agreed that macroeconomic fundamentals were sound enough to support exchange rate stability. This obviously begs the question then why is the exchange rate not stable? Their answer is behavioural factors which I believe in simple terms means people are just doing it. Which presents a problem, if you refuse to acknowledge the real reasons behind a behaviour how can you address it? The behaviour on the parallel market, the existence of the parallel market is a response to conditions not the cause of them.

RBZ commitment

The RBZ committed to the following (in simple English);

- To “continue” tightening Zimbabwean dollar money supply

- Speed up the introduction of exchange rate linked investment products

- Increase interest rates to prevent people borrowing to buy foreign currency

- Continue with the auction system

- Pay up US dollars not yet received from the auction

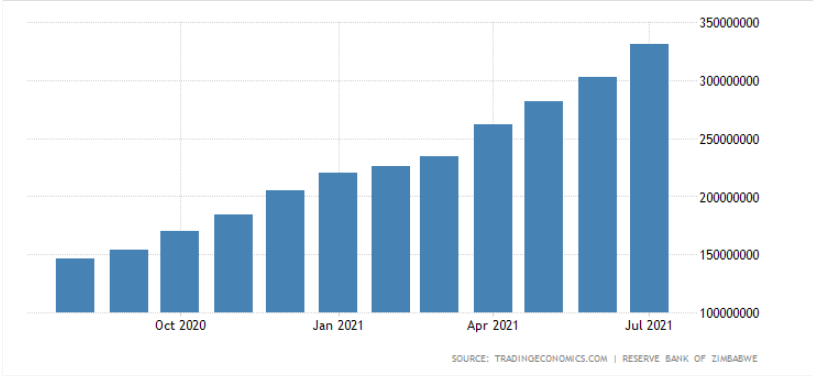

The graph above tells the story of broad money supply over the last 12 months. It has just over doubled. Coincidentally the parallel market exchange rate has done close to the same, doubled from that relative stability of 90 we experienced this time last year. On the point of an auction backlog surely this shouldn’t be the case if they are auctioning foreign currency they have. This suggests that once again the authorities are writing cheques that they cannot honour.

Bankers association

On the part of the Bankers Association of Zimbabwe, the only association that was named as a participant in the meeting other than the RBZ, they agreed to continue doing things that they should’ve been doing all along including guaranteeing the authenticity of auction bids and improving oversight on overdrafts. The latter is very important because it was not cited as being part of the problem yet it amounts to borrowing which can be abused for purchasing foreign currency on any market.

Retailers Associations

The unnamed retailers’ associations agreed to their measures but also made their pleas to the RBZ and other authorities. It gets a little comical here. The retailers, according to the RBZ, cited 3 key issues;

- Illegal money changers hanging around their shops

- Bringing to book the people behind the money changers

- Unlicensed traders operating outside the law (so no consequences)

Fair play to these unnamed retail associations on points 2 and 3 but the first point does leave you wondering what their real concern is. In the absence of currency traders, people will be forced to accept whatever pricing the retailers offer and more importantly hand over hard currency to the retailers. Of course, the money changers are flouting laws but their persistence and how much people use them suggests they are solving a problem that matters a lot to people. After the discount debacle that played out last week, the retailers were “allowed” by the RBZ to offer discounts in the normal course of business. The RBZ has also allowed retailers to add an extra 10% to the official exchange rate as Bureau de changes have been allowed to do.

The statement with a short note stating that manufacturers will “ensure reasonable pricing” whatever that means.

And the point is?

After two weeks of chasing down alleged users of social media and telecommunications networks to facilitate illegal foreign currency dealings the exchange rates march to 200 has not stopped. I for one regret earlier saying I missed the active RBZ we had as the activity is being directed to more window dressing rather than solving the real concerns. Concerns that were expressed by the Confederation of Zimbabwe Industries in an unsigned letter dated 10 October, a day before this RBZ meeting. The auction system backlog simply tells us they are selling more currency than they have, essentially taking currency pre-orders. The popularity of the parallel market, evidenced by the surge in the rate is understandable under such circumstances. Unfortunately, the RBZ has chosen to huff and puff and blow down a house built with bricks of necessity. Surely there is more to follow.