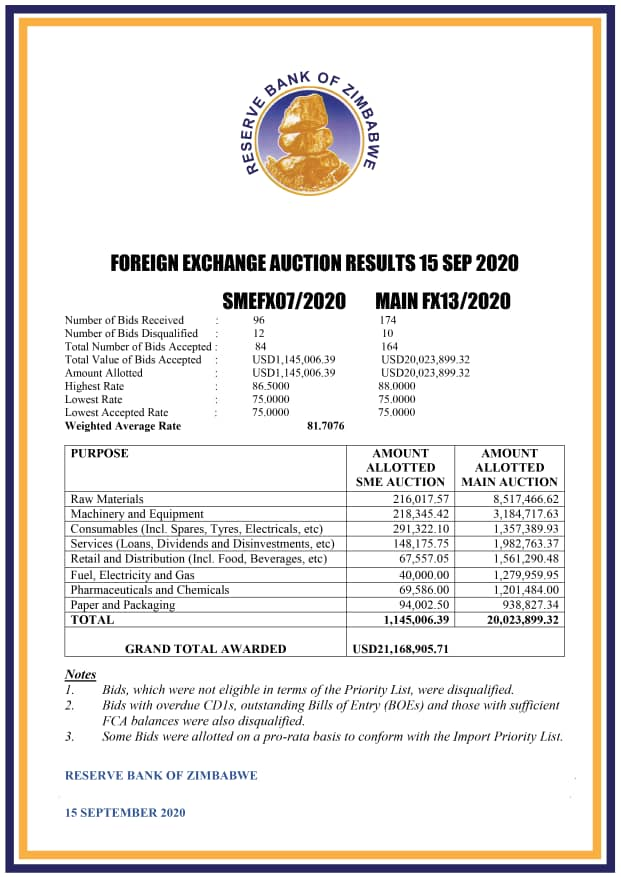

Zimstat yesterday published its latest inflation figures for August 2020 and the results were not so surprising, given all we have come to know about inflation reporting in Zimbabwe. The month on month inflation dropped to 8.44% down from 35.53% for July 2020 while year on year inflation dropped to 761.02% down from 837.53% for July 2020. Coincidentally the latest auction produced another round of appreciation for the Zimbabwean as the weighted average rate came in at 81.7076 which represents a 7% appreciation for the Zimbabwean dollar.

Increasing at a slower rate

While inflation is still very high the slower rate of increase is somewhat consistent with the experiences Zimbabweans have in their day to day lives. With most prices still pegged to the US dollar via the parallel market rate, there have been smaller price movements than before as the parallel market has played between 80 and 90 for about a month now. To look a little deeper into it the money supply has been tightened by the RBZ and without wanton money supply growth, both prices and the parallel exchange need not go up.

Not the first time

While we can give real-world reasons and examples the picture Zimstat has painted in the past does not inspire confidence. June 2020 inflation also represented a decline in inflation from 785.55% in May to 737.26% but this wasn’t exactly the experience Zimbabweans were going through. If anyone was quick to celebrate they were floored by the post-2009 record inflation that came in July. A change, any change is welcome but Zimstat figures have been questionable, to say the least.

Not the full picture

Another factor that must always be considered is the current state of things. The lockdown which has dragged on for over 6 months now has constrained a lot of activity. Transport, travel, informal businesses, supply chains and consumer spending have all been affected. This is not business as usual. Lockdown restrictions are being gradually lifted with the government recently allowing domestic tourism to start up and now extending business operating hours though a curfew is still in place. So clearly this is not quite business as usual.

Zimbabwean dollar appreciates

For some strange reason, the Reserve Bank of Zimbabwe continues to separate the SME auction from the Main auction despite the two happening in the same place, on the same day, run by the same people and all contributing to the same weighted average rate. So really there is no justification for this. Others have tried to argue that it provides more information but surely the RBZ has more useful they could give if that was their intention. When the auction weighted average started to show signs of a slowing increase people celebrated the beginning of stability. Many, if any did not foresee the situation we have today.

The highest bid rate for the auction was 88 while rates on the parallel market are reportedly around 90. This slight discount is still attractive as long as the foreign currency is supplied without hiccups. The lowest accepted bid rate which happens to also be the lowest bid at 75 shows a narrowing spread. The question of stability is one that cannot be answered now. Stability can be measured over time and while the current rate represents the state of things in the market, this can change very quickly.

Now the problem

Many times we’ve stated that the weighted average exchange rate is only indicative and is not the effective rate anyone pays, even market participants. Now the rules tell us that pricing must be done using the auction rate. So what we are about to see is a situation where retailers should reduce Zimbabwean prices or retailers will have increased US Dollar prices. Your prices are either US dollar prices stated in Zimbabwean dollars or vice versa. Unfortunately, we are likely to get the latter as Zimbabwean dollar prices will be kept at current levels. The sticky point is that many are still excluded from the auction market and for them, this changes nothing. They are likely to keep up the questionable pricing we have seen in recent times.

The fact that Zimbabweans will continue to experience what can only be described as strange pricing is further compounded by inconsistent and questionable reporting on changes in prices by Zimstat. This is not to accuse Zimstat of wrongdoing but simply saying people will find it hard to rely on Zimstat inflation figures. For the meanwhile, things look to be positive but as the saying goes, time will tell.

The real auction exchange rate will only be achieved if a statistical representation of all the players who want forex a represented at the auction, ie, big corporates, SMEs, cross-borders, individuals with foreign health and medical needs…

My sentiments exactly Cool Head. This one excludes too many participants.