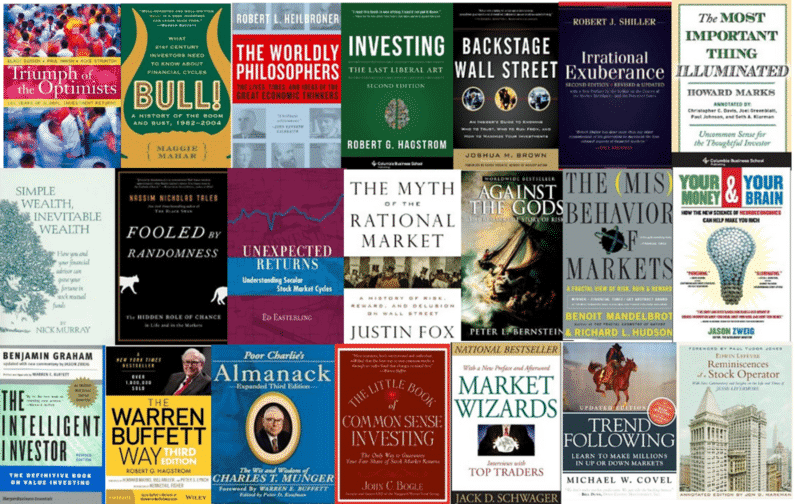

Investing, while often thought of as an activity for those who have an excess of money and not enough ways to use it otherwise is a very deep and interesting discipline. Many books have been written on the subject, some better than others. Here is a list of 10 of the best books I have come across on the subject of investing.

Beating the Street – Peter Lynch

The book title might sound more like it was a project co-written by a Finance Minister and Reserve Bank governor who wanted to achieve dominance over a parallel market but far from it. This book is all about principle and systems when building an investment portfolio. While its written for stock market investors the core principles can be taken outside the markets. The examples in the book may feel outdated now but will provide a great learning platform.

Rich Dad, Poor Dad – Robert Kiyosaki

Rich Dad, Poor Dad is a gateway book for many people into the world of reading about personal finance. For many it is the first book they read and as such people tend to look at its contents as the basics. Mastery is consistently performing the basics and regardless of your skill level or how many times you’ve read it Rich Dad still has lessons for you. Its lesson is simple, control your money.

The Intelligent Investor – Benjamin Graham

Benjamin Graham’s book though written long ago still guides investors today. This book is full of important lessons for stock market investors. One caveat is that it uses a lot of data and assumptions that are specific to the American Market and you cannot simply lift ideas from the book and apply them in Zimbabwe for example. None the less the principles it teaches are valuable.

Rule #1 – Phil Town

If you’re going to read only book on stock market investing make it this one. Phil Town has a system that is so simple it has just one rule. And that is all you need if you understand the guiding principles and learn to apply them. Another one written with specific circumstances of the American Market but still applicable to other situations and quite easily.

Think and Grow Rich – Napolean Hill

Think and grow rich, regarded by many as one of the best books on personal finance is certainly a masterpiece. If your investing journey is a building then TAGR can be considered the foundation upon which the house is built. The title misleads many into images of people meditating and chanting for money to manifest but far from it the book is about adjusting the mindset because thoughts become actions and actions become things.

The little book of common sense investing – John Bogle

This book is a bittersweet read if you’re investing in Zimbabwe. Written by John C Bogle who started the Vanguard Group; read about them while you’re at it. The book is for stock market investing and touts the virtues of index funds over mutual and other funds. Sweet because it does make a lot of sense to invest in index funds over others but bitter because this option isn’t available easily in Zimbabwe. Until the commencement of ETFs in 2021 we have nothing close to it. You can however learn the principles and employ them on a personal level.

Essays of Warren Buffett – Warren Buffett

Another good one for the stock market investors, especially those who may not have a strong background in finance and investing this book is worth the read. It is a collection of letters from Warren Buffett to investors of Berkshire Hathaway and reveals practical examples of the ideas of value investing in action. And while it isn’t a crystal ball into the future, these ideas have worked in the past.

Richest Man in Babylon – George Clason

The Richest Man in Babylon is told through the fictitious tale of a man named Arkad. What RMIB excels at is bridging the gap between the person who has just decided to start investing and the accomplished person with money to invest. That is to say it teaches us how the millions are made whereas most texts start with the millions already there. Absolutely essential reading on many levels but probably the best book to cement the relationship between investment and savings.

Principles: Life and Work – Ray Dalio

Ray Dalio is a hedge fund manager and that should be all the convincing you need to read this book. On a serious note Dalio talks about personal principles which he credits with his success. Investing, whether stock markets or otherwise is not about hot stock tips, flipping properties for hug profit or finding the next Tesla in its IPO. Investing is a disciplined activity guided by principles. Having them is 50% journey and sticking to them is the other 50%. A good read for anyone at any stage of investing.

The Automatic Millionaire – David Bach

All the knowledge in the world is useless without action. David Bach’s book is about automating that action. I can tell you from personal experience that this book will transform how you approach investing in any form. Bach’s approach can be described as making the decision once and making the continuous processes automatic where possible.

While the list is biased to stock market investing it is more because of the investment climate in Zimbabwe which presently offers little outside of stocks.