When the Reserve Bank of Zimbabwe launched the Gold coins as a store of value, they promised that they would later bring gold coins of smaller denominations to offer a store of value to more people. From the 15th of November 2022, these smaller gold coins will become available in the market.

The decision to introduce the smaller gold coins was well informed as the 1 troy ounce gold coin has a market value in the region of US$1 800, which isn’t exactly the sort of money, whether, in US dollars or Zimbabwean dollar equivalent, that can afford to park away at no interest for 6 months. Let alone have it. As the founder of Grameen bank of Bangladesh, Muhammad Yunus wrote in his book Banker to the Poor, ” people do not lack ways to make money, but they lack methods to store their money.

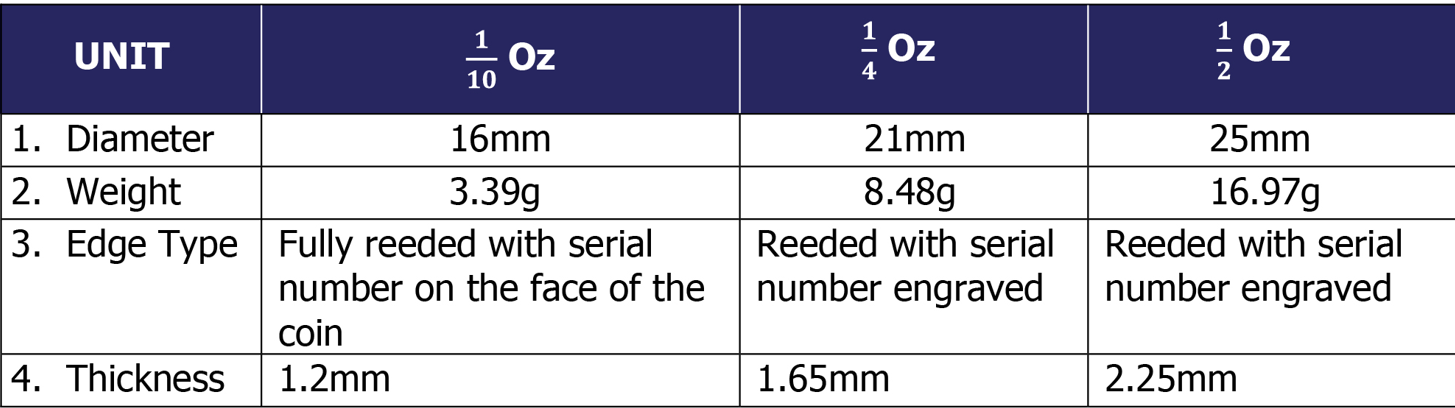

Three additional coins will be minted, the half ounce (16.97 grams), quarter ounce (8.48 grams) and one-tenth of an ounce (3.39 grams), at current international gold prices (US$54.97 per gram) that gives them an intrinsic value of US$932.84, US$466.15 and US$186.35 respectively. To put that in perspective, at the current auction rate (1:636.21), the intrinsic value is ZWL$593 482.14, ZWL$296 569.29 and ZWL$118 557.73, respectively. This is a little more accessible than the US$1800 for the 1 troy ounce gold coin. So this move makes the Gold coins more accessible to a greater number of participants in the Zimbabwean economy. Remember to add 5% for minting costs to find its price.

Still not a currency

Zimbabwe has a history of misinformation ruling the day. Despite the insistence in all material and in speeches by both Finance Minister Professor Mthuli Ncube and Reserve Bank Governor Dr John Mangudya that the gold coins were being introduced as a store of value, some sections tried to paint the move as the introduction of gold as a currency in Zimbabwe. It is still far from it, and placing the smallest coin at twice the value of the highest US dollar note (US$100) means the gold coins are still less favourable for transacting. That’s before we even talk about the 6 month vesting period.

All that glitters is not Gold

The observant would have noticed something a little strange about the intrinsic values of these new gold coins. When we did our calculations on the initial 1 troy-ounce gold coin (5 July 2022), gold was valued at US$1 809.62 per ounce or US$58.19 per gram. Today gold is valued at US$1 709.57 per ounce or US$54.97 per gram. That’s a 5.53% decline in the value of the gold in the coin in just under 4 months. The gold coins may have the ability to store value but clearly very little ability to protect from losing value. This is compounded by the fact that the holder of the gold coin cannot press the exit button until 6 months after purchase, even if the market price is crashing.

With all other terms remaining the same, we shouldn’t expect too much change from what we have seen before. Many gold coins will be sold for Zimbabwean dollars and very few for US dollars. The policy has clearly created wins for the government, aiding in arresting the money supply.

Great article there. On the plus side, the price of gold may go up before the six months.

Thank you Zee. You’re right, it’s possible that it may recover.